14 min read

When deciding a price for your new product, the best place to start is with your customers. While many businesses will set product pricing based on internal factors like desired profit, or cost of goods made, using pricing and value surveys you can find out how much your target customers would be willing to pay.

They all use a pricing survey as a starting point and then apply different analytical methods to help identify the perfect price point.

Read on to find out how each study works, when it’s useful to use it, and explore our sample pricing survey templates to get started with your pricing and value research today.

How you price your products is an essential ingredient to a successful product launch. Product pricing doesn’t just dictate the dollar amount at which you will agree to part with your product — price is communication and signal too.

For example, a high-end fashion designer would never agree to sell their perfume for the same price as a dollar-store aftershave, not just because their profit margin would suffer, but also because that price would signal a cheapening of their entire brand and make it less likely shoppers would be willing to spend as much on their other products.

It can be the difference between success and failure — price too high and your product may be out of reach for your target audience; price too low and you could signal to the market that it’s of lower value than it really is.

A pricing study is how you understand all these factors to settle on a price point that:

Pricing studies work by asking respondents a series of questions about what they’re willing to pay for a product. There are a few approaches and methodologies you can employ, but at their heart they’re all about evaluating how, in the real world, consumers will value your product, and how much they’d be willing to part with to get it.

Add that insight to key operational data like the cost to manufacture or provide a service, and expected sales volume, and you can make accurate predictions about the success of a product in market based on various price points.

Product managers will typically use the insights gathered from pricing and value surveys to determine the merits of increasing prices (to boost profit margins) or evaluate the impact of decreasing prices.

You can run effective studies using a variety of research approaches, including Van Westendorp models, Gabor-Granger Price Sensitivity studies, and price rating scales.

Before we go into detail about how each method works, and what you need to do to get started, here’s a quick comparison of the four main approaches:

| Price ratings scales | Van Westendorp Pricing Studies | Gabor-Granger Price Sensitivity | Conjoint Analysis | |

| Best for | When you want to compare a set of predefined price points to see which would be most acceptable to your target customers. | When you have a product and you aren’t trying to change it, but you don’t know the right price range. | When you have a defined product and a specific price range, but you don’t know what it should be priced at within that range. | When you have multiple product options or want to capture other factors in addition to price. |

| Benefits | Simple to program | Simple for respondents. Simple to program. Suggests an optimal price point driven by consumers | Simple for respondents. Gives you an optimal price range | Provides more details than just pricing. Allows you to create optimum pricing and packaging |

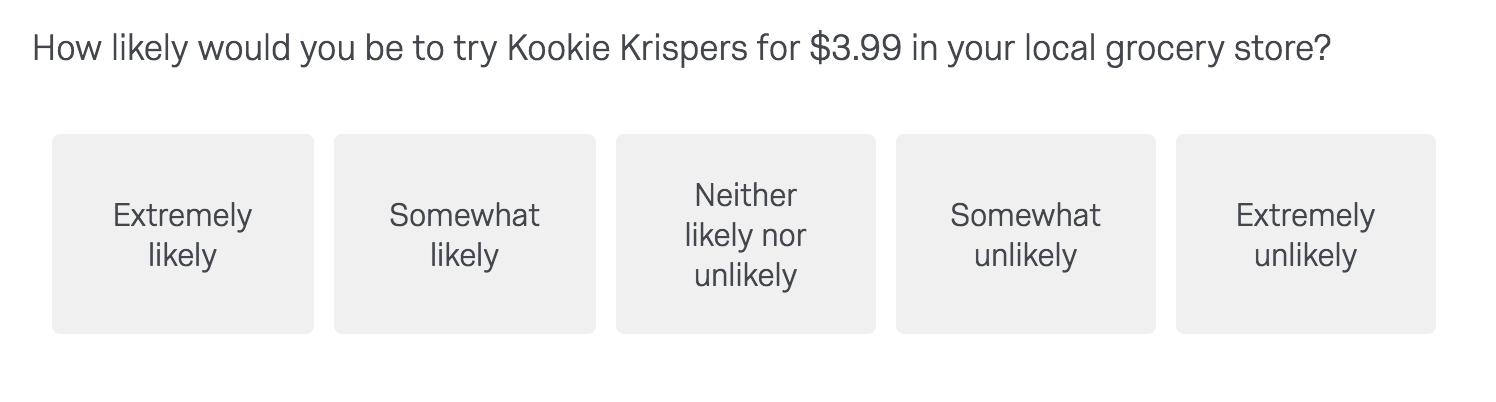

Rating scales are one of the simplest ways to use a pricing survey to understand a consumer’s preference.

They use graded scales to indicate the importance or acceptability of a given concept, and can help you understand:

Unlike the other methods we’ll explore below like Van Wetendorp or Gabor Granger studies, price ratings scales won’t pinpoint an optimal price point. Instead, they’re used to measure the acceptability of pre-defined prices and can be a useful study if you’re looking to increase or decrease the price of an existing product and want to see how that would impact sales.

Given the advance in modern research technology that makes more complex techniques accessible to anyone with an internet connection and 10 minutes to set up a study, price ratings scales are becoming less common. After all, why limit yourself to a few pre-selected prices when you can automatically identify the optimal price point using one of the other techniques?

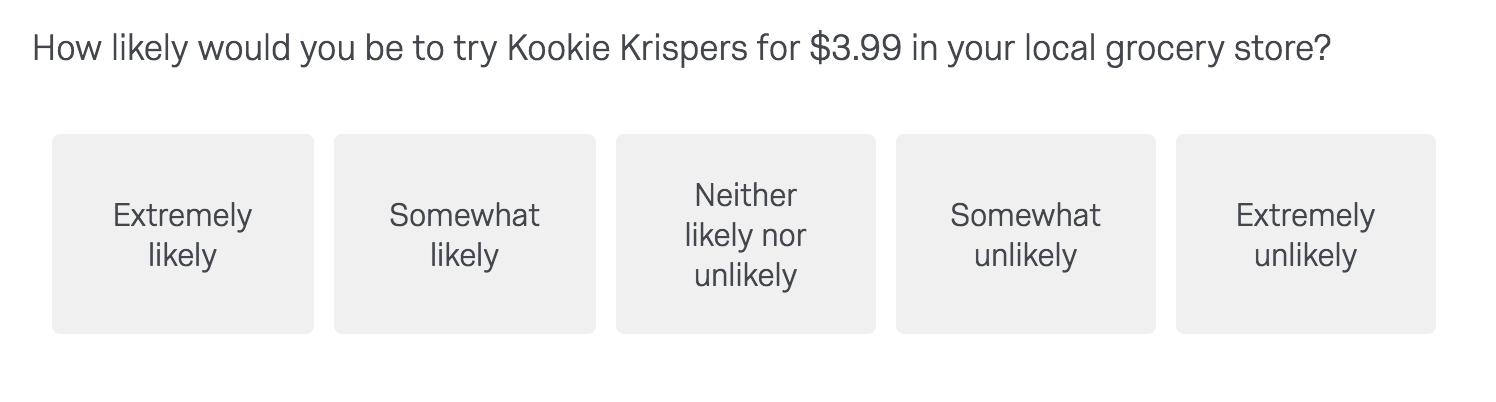

The Van Westendorp method uses a series of questions — presented to respondents after they’ve seen a product description — to identify key psychological price points and identify price elasticity of a product.

Respondents are asked:

The price measurements in each of the respective categories provide a distribution of perceptions about the acceptable price of the product. The analysis of these distributions will help answer such questions as:

From there, you can see the optimal price point for your product.

The key to an effective Van Westendorp study is to create a price scale so that lower is not always better and so that you can differentiate users of a product from non-users.

It’s worth remembering too that respondents often report a preference for an expensive product over a cheaper alternative, but this may not hold true in an actual purchase situation so validation measures are essential.

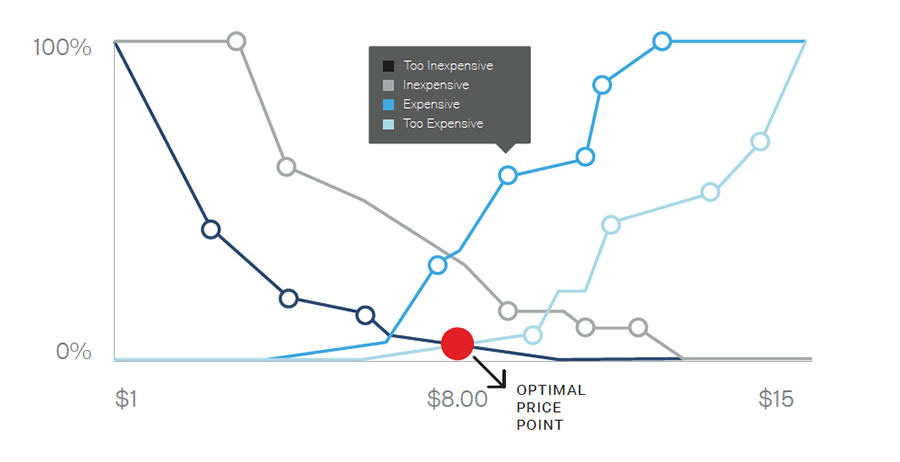

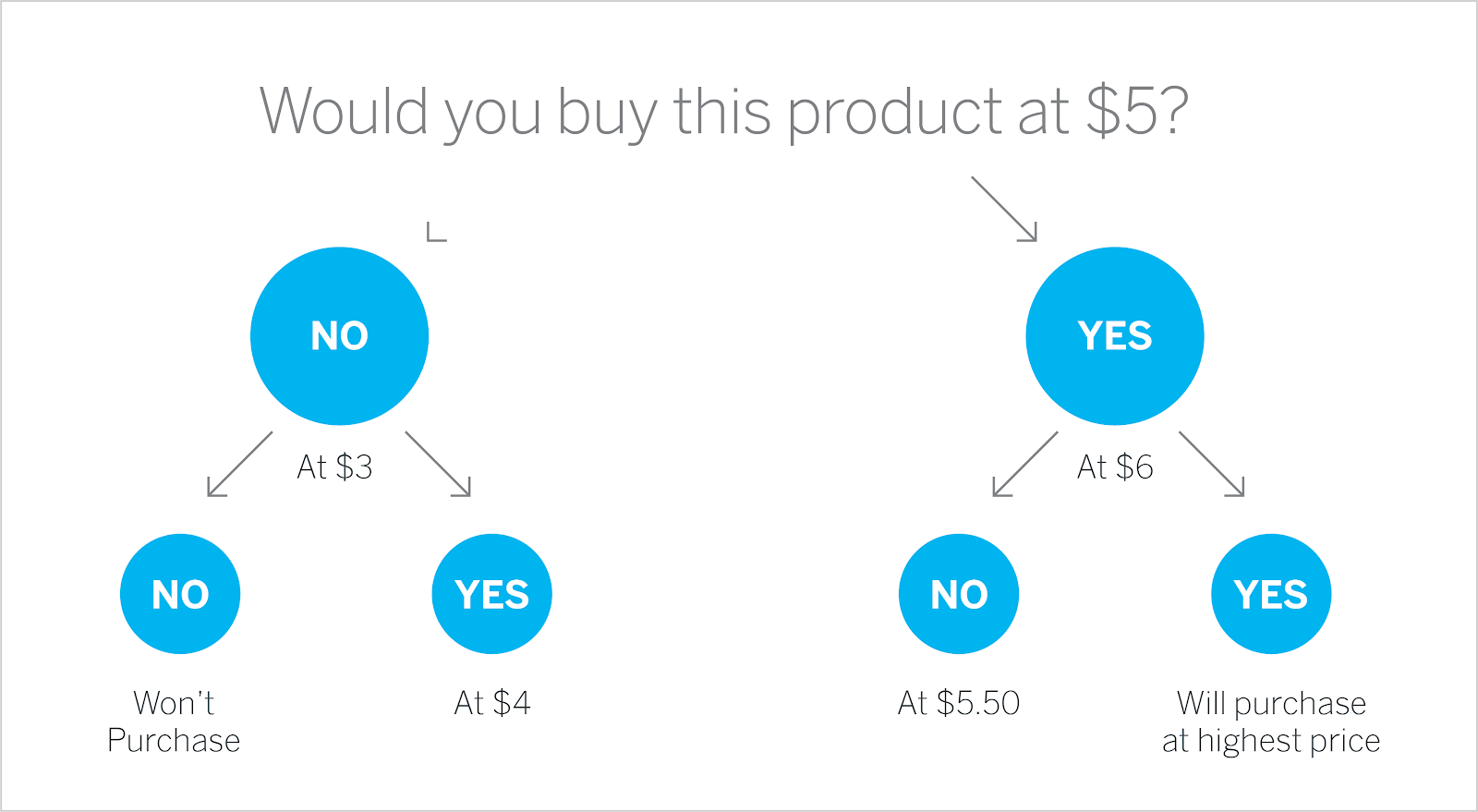

This pricing survey works by trying to establish the maximum amount someone would be willing to pay for a product or service.

Respondents are presented with set price points to determine the highest where each one would purchase, and then your responses are used to find the optimal price range for your target customer.

These pricing surveys use advanced survey logic to continually move through a series of questions to get to the highest price point.

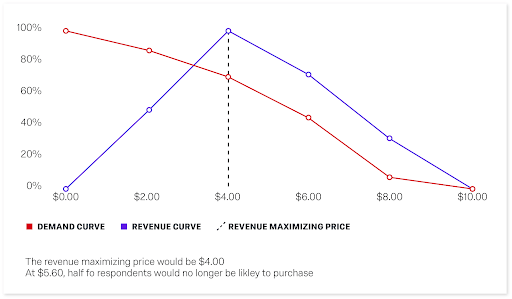

The resulting analysis gives you two key pieces of information:

One of the most complex, yet most accurate pricing studies, conjoint analysis is a method that enables you to see the trade-offs consumers would make in the real world.

It’s typically used where you have more variables than just price to take into account, for example if you’re deciding which features to include in a product, or which services to include in a customer offer.

Respondents are shown a series of configurations, at different price points, and asked to choose between them. The configurations can be randomized too, so you can see the different trade-offs customers make, for example would they be willing to pay more to have a 4K screen on a laptop, or would they choose an HD screen at a lower price point.

While traditionally conjoint was the most complex study to run — often making it inaccessible to all but the most seasoned researcher — today’s market research software has made it as simple to run as any other pricing survey

There’s a number of different types of conjoint analysis you can use:

With so many options available, it’s definitely worth using conjoint analysis software that automatically chooses the right test for your pricing study.

Whatever type of conjoint analysis you use for your pricing study, the results will show you how changes to pricing, as well as other attributes such as the features you include in your product, will impact its success.

With Qualtrics Conjoint Analysis your results are presented with the optimum package, as well as a simple to use simulator, so you can build bespoke packages and see how changes to pricing will impact everything from customer preference to market share.

While Van Westendorp, Gabor Granger and Conjoint Analysis are the three most common pricing studies used to determine product pricing, there are alternative ways of assessing pricing.

It’s not uncommon for companies to test pricing in the wild by presenting different market segments with different product, pricing, or purchase information. This is easiest done through an eCommerce store, where you have plenty of data on your users to be able to customize what they see when they land on your website.

However, you can also do this in location-based businesses like restaurants, retail stores etc. by running pricing experiments in specific locations and comparing the results against your control.

These studies can be useful to determine real world behavior, however they are limited in scope. For example, while a Van Westendorp study will get you the optimal price point in a few days of fielding a pricing survey, in-store or online studies may need weeks or months of data to get significant results. Even then, for your real-world studies you’re evaluating a finite number of price points, whereas many of the methods we’ve discussed in this article will choose the perfect price point for you based on advanced statistical analysis.

Tracking the effects of pricing on market share over an extended period of time can give you a unique view of price-demand relationships. Monthly or quarterly measures show changes that result from marketing programs, competitive action, or general market demand.

These trend analysis studies estimate price-demand relationships and can show the interaction between price and brand sales if market measures of price changes are included.

Again, this method can take months or quarters to get the data you need, compared to the fast turnaround of conjoint or Van Westendorp studies run through a market research platform.

Get started with our free pricing survey template